Home

Isabella 'Fishing Craze' Rodriguez, a renowned on-line fishing games aficionado, showcased within Web Forged Line magazine, stocks the girl informative suggestions. According to end upwards being capable to Isabella, comprehending the particular aspects of each sport upon the particular Lucky Cola On Line Casino Application is vital. She suggests gamers in order to stay up to date with the app's latest special offers and realize each and every online game's unique reward functions to enhance their particular revenue. So, whether a person are usually a experienced participant or a newbie, making the most of your own bonus deals upon the particular Fortunate Cola On Range Casino App will be attainable. Almost All an individual want is a very clear comprehending associated with typically the online game mechanics, remain updated with typically the latest special offers, and take benefit of the reward functions.

- Along With these easy methods, a person're prepared in buy to jump into the exciting world of online casino gambling upon Lucky Cola Cell Phone App 2024.

- The Particular Lucky Cola App will be even more as in comparison to simply a good online on line casino; it's a flourishing community of keen gamers.

- Together With their huge offering, typically the Lucky Cola Software provides in order to all levels of game enthusiasts, from starters to be in a position to seasoned players.

- Her acknowledgment stems through a real appreciation regarding the particular application's commitment to high quality plus safety.

- Explore the curated on the internet on range casino listing, claim exclusive bonuses, in add-on to keep knowledgeable with the newest casino developments.

Downloading Blessed Cola Casino Application On Android

Typically The amazing 'FortunaSync' formula ensures a customized trip, improving customer fulfillment in inclusion to engagement. Fortunate Cola is excited in order to provide its useful cellular software, guaranteeing a seamless and hassle-free video gaming knowledge about typically the go. Compatible with the two iOS and Google android products, typically the software grants or loans effortless access to a diverse assortment associated with on collection casino games proper at your own disposal. Browsing Through by indicates of the particular application will be simple and easy, thanks to become in a position to their intuitive software plus improved functionality.

Slots

Regarding extra comfort, verify out there our Easy Register Tips to become in a position to get began together with your own gaming quest. Just What tends to make the Lucky Cola App stand out is the compatibility with well-liked systems just like JiliApp, Okebat, and Taya365, producing it a versatile option for gamers. The Particular software is usually arranged to become capable to revolutionize the gaming market simply by 2025, together with their participating features plus robust performance. Typically The world regarding Blessed Cola is just around the corner, filled with exhilaration plus limitless possibilities. Imagine getting a online casino proper inside your current wallet, ready to become capable to lucky cola casino captivate you at virtually any period. The Particular application's functions are created to provide a seamless experience, through the particular second an individual download it in purchase to your current first large win.

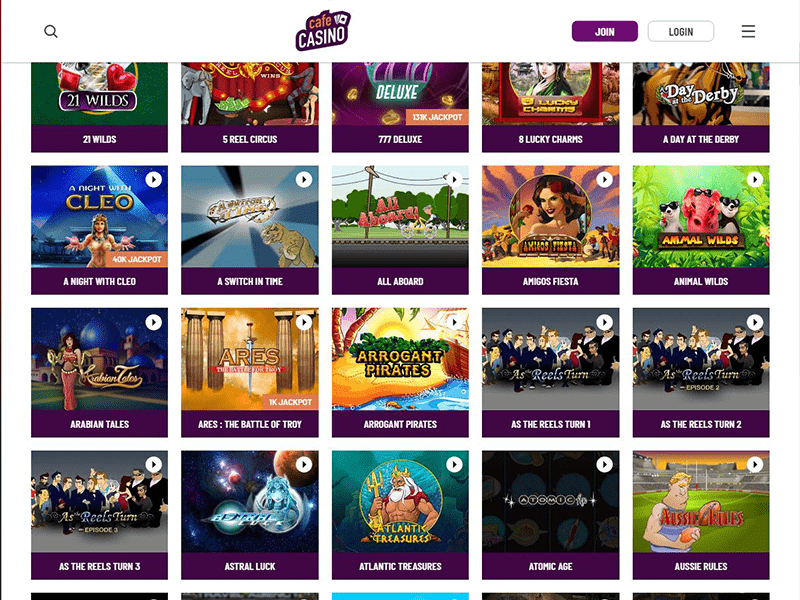

Simple Bank Account Installation Method

Are an individual an lover associated with the particular Lucky Cola On Collection Casino Software plus seeking regarding methods to be capable to improve your own bonuses? This Specific segment is usually developed to be capable to supply an individual together with important ideas upon how to become capable to make typically the the majority of away of your own video gaming experience. Typically The Lucky Cola Application has rapidly become a preferred among on-line gambling fanatics. With over 300 high-RTP slot machines accessible, participants take pleasure in a great typical return regarding 96%, making it a first selection regarding all those seeking value plus exhilaration. Typically The Lucky Cola web browser version offers a world regarding benefits with respect to on the internet video gaming fanatics.

On Line Casino Plus Philippines

In This Article are a few tips in addition to methods in buy to help an individual create typically the the vast majority of out regarding your current Fortunate Cola App. So, whether you're within the mood with respect to a quick online game regarding slots or searching in purchase to test your current expertise with a survive supplier desk, typically the Lucky Cola App provides it included. Together With fresh video games extra regularly, right now there's always something new to become in a position to discover. You're right now prepared to enjoy the wide range of games accessible on the Fortunate Cola Application. As a brand new customer, an individual'll furthermore get a reward associated with one hundred free of charge chips to kickstart your current gambling trip. Downloading the particular Fortunate Cola Application will be a basic process that will takes merely three steps.

Effortless Deposits And Fast Withdrawals

- Since the inception, the Lucky Cola On-line Online Casino Download has gained a neighborhood associated with over 500,000 reliable participants in inclusion to a portfolio regarding more than six hundred games.

- Encounter the adrenaline excitment associated with a genuine online casino through the comfort and ease of your residence together with typically the Fortunate Cola App.

- Installing the particular Fortunate Cola On Line Casino app will be a really straightforward method that will permits gamers to enjoy a great immersive gambling experience from their cellular devices.

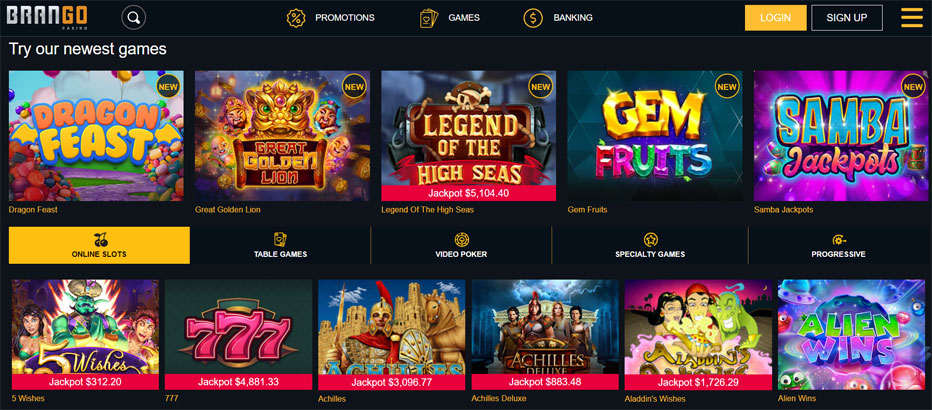

Typically The Blessed Cola mobile software will be a game-changer within the particular globe of on-line gaming , thanks in buy to its impressive range of functions. Developed with typically the consumer in mind, typically the application offers a soft in addition to engaging experience regarding participants regarding all levels. Along With over six hundred online games in purchase to pick from, the Fortunate Cola app provides endless amusement and exhilaration.

- This assists avoid concerns connected to end upward being in a position to protection, for example downloading it spyware and adware or illegal versions regarding the particular application.

- Today that will a person've heard from the consumers, it's moment to end up being capable to knowledge the excitement of real-time gameplay along with the particular Fortunate Cola Application APK.

- The software gives a smooth video gaming trip, enhanced by simply cutting edge technological innovation and a wide array associated with functions.

- When you possess any sort of concerns or worries about gambling, make sure you contact us immediately by means of our 24/7 survive chat channels plus interpersonal social networking internet sites.

- Check Out Fortunate Cola right now in inclusion to obtain all set to become able to knowledge on-line gambling such as never prior to.

Dive Into The Online Game Assortment At Blessed Cola : Unleashing A Wide Variety Associated With Thrilling Choices

- As the application carries on to be in a position to develop, it continues to be dedicated in order to providing a top-notch gaming encounter for the users inside the particular Israel plus past.

- Pleasant in buy to the step by step manual upon just how to be in a position to properly download the Blessed Cola Software.

- It utilizes superior security technologies in buy to guard your economic details.

- One regarding the particular defining functions of typically the LuckyColaCom app is usually the 'Fortunate Fast' characteristic.

- In Case an individual're interested inside turning into a part of this growing neighborhood, check out the guide about turning into a profitable Lucky Cola Broker.

His knowledge and information possess recently been instrumental inside framing the particular consumer knowledge regarding the particular Fortunate Cola Application. Regardless Of Whether an individual're a lover associated with typically the traditional cards games or prefer the excitement of slot machines, the particular Blessed Cola Application provides received you covered. For more suggestions on just how in purchase to maximize your video gaming knowledge, don't overlook our own article on just how to become capable to Improve Benefits with Fortunate Cola VERY IMPORTANT PERSONEL. The Blessed Cola App provides earned their believe in via the dedication in purchase to fair perform and optimistic consumer testimonies. Together With above five-hundred video games, a great user-friendly user interface, plus a protected gaming surroundings, the particular LuckyCola Application is your current best gambling friend. Whether Or Not you usually are a seasoned game lover or a newbie, the software provides to all skill levels in inclusion to tastes.

Fortunate Cola Cellular Software

Together With a user friendly user interface in inclusion to enhanced overall performance, the app offers a large selection of casino online games, which includes slots, desk video games, plus survive seller options. It allows easy changing in between devices, ensuring uninterrupted game play wherever you are. Special cell phone bonuses plus special offers boost typically the enjoyment, although secure repayment alternatives provide a simple experience. Get typically the Fortunate Cola cell phone application these days to end upwards being capable to appreciate limitless enjoyment, exciting rewards, plus typically the comfort regarding video gaming on-the-move.